Welcome to the Exciting World of the Subconscious!

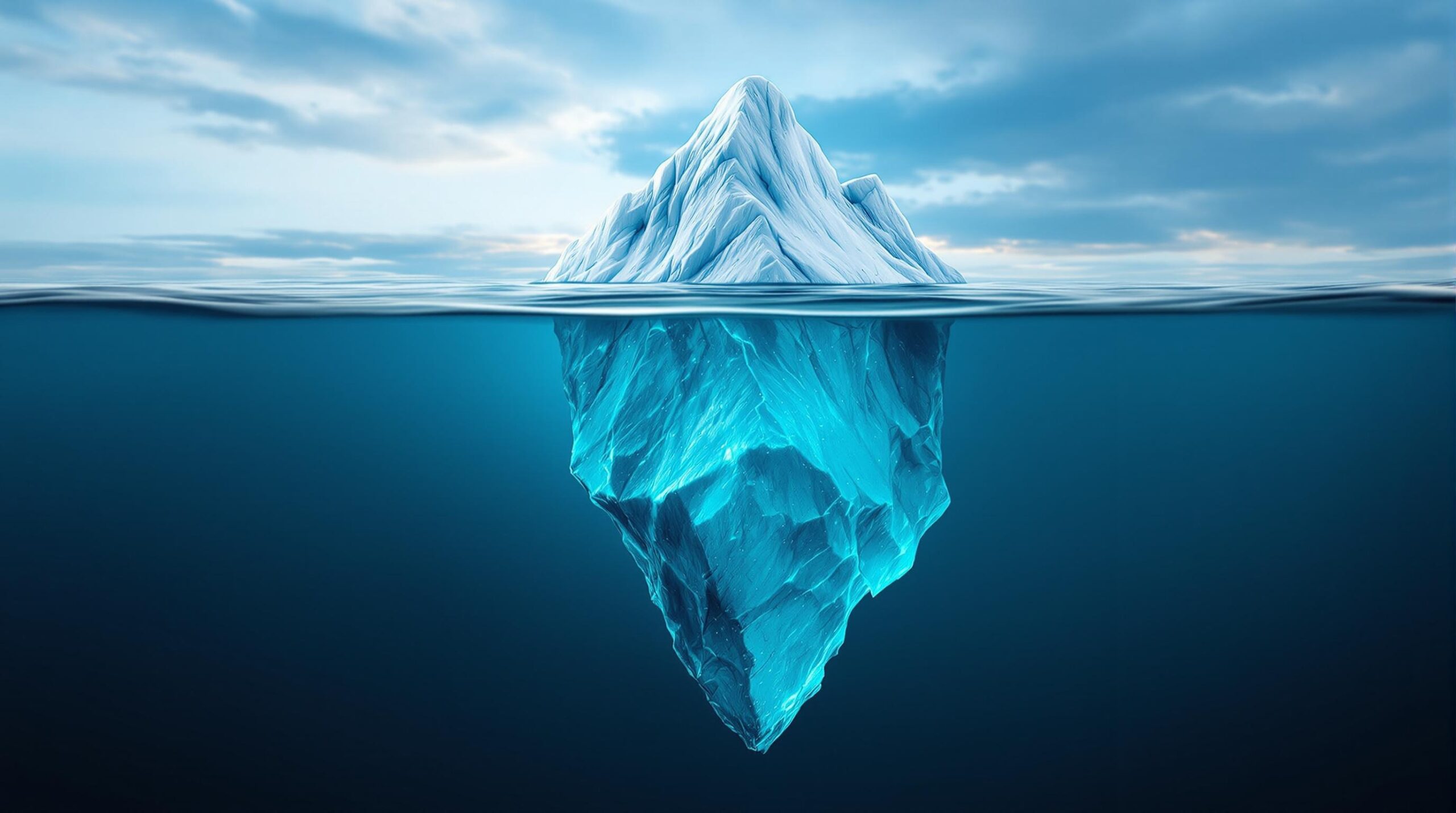

Imagine standing on a beach, staring out at the vast ocean. What you see is just the tip of an enormous iceberg. The part that’s above water is like your conscious mind—the thoughts and decisions you’re aware of. But just beneath the surface lies a massive foundation of ice, representing your subconscious mind. This hidden part is where most of your habits, beliefs, and decisions come from, and it has a huge impact on your life!

Diving Deep

So, what does this mean for you, especially when it comes to money? Well, just like an iceberg can seem small from above, your conscious thoughts about wealth might not reveal the entire picture. What’s really guiding your financial choices is often buried deep in your subconscious. This is where your fears, dreams, and long-term beliefs about money are formed. Are you ready to dive deep and recondition your subconscious to help pave your way to wealth?

In this article, we’ll explore how understanding and reshaping your subconscious thinking can lead to better financial decisions. We’ll guide you on a journey to uncover hidden beliefs that may be holding you back and show you how to replace them with powerful, wealth-building ideas. It’s time to take control and unlock a treasure chest of potential that’s just waiting to be discovered!

The Role of the Subconscious in Financial Decisions

The subconscious mind is a powerhouse that largely dictates how we manage our finances. It shapes our relationship with money in profound ways, often without us even realizing it. To understand this influence, consider how our early experiences with money can echo throughout our lives. From childhood lessons about spending and saving to societal norms around wealth, these absorbed beliefs lay the groundwork for lifelong financial habits.

For example, if you grew up in a household where money was scarce, your subconscious may associate wealth with anxiety or guilt. Alternatively, celebrating abundance may make you unconsciously assume that financial prosperity is your birthright. These ingrained beliefs can either propel you towards financial success or anchor you in a pattern of self-sabotage. Recognizing the duality of these attitudes is crucial in our quest for financial empowerment.

To make this concept more tangible, let’s explore some common subconscious beliefs that can shape financial decisions and motivations:

| Subconscious Belief | Impact on Financial Behavior |

|---|---|

| “Money is the root of all evil.” | May lead to avoidance of wealth-building opportunities and a mindset that associates prosperity with moral shortcomings. |

| “I don’t deserve to be wealthy.” | Can manifest as self-sabotage, preventing you from following through on projects that could lead to financial gain. |

| “Saving is necessary for survival.” | This belief can lead to excessive frugality, causing missed investments and stunted financial growth. |

| “Wealth equals security.” | Encourages proactive financial planning, investments, and seeking new streams of income; however, it can also result in obsession with financial security. |

By examining these beliefs, we can start to unveil the underlying motivations driving our financial behavior. As we engage in this self-discovery journey, it becomes possible to identify limiting beliefs that hold us back. The key is to confront these subconscious narratives and, in doing so, transform our relationship with money.

Ultimately, the subconscious is not merely a shadowy figure influencing our lives; it is the guide that navigates our choices, often informing decisions in subtle but significant ways. By shedding light on these hidden facets of our thinking, we can redefine our financial narratives and embrace a more empowered path forward.

As we move into our next segment, get ready to learn about reconditioning—an exciting process aimed at reprogramming the subconscious. With the right tools and mindset, you can reshape how you view and interact with money to create a brighter, more prosperous financial future.

Reconditioning: What Does It Mean?

Reconditioning, at its core, is the process of consciously redefining our mental frameworks and beliefs, particularly those rooted in the subconscious. It entails actively engaging with our deeply held convictions about money with the goal of reshaping them to align with our aspirations and potential for financial success. Much like spring cleaning a cluttered attic, reconditioning requires introspection and a willingness to let go of outdated or limiting beliefs that no longer serve us.

To successfully recondition our subconscious beliefs around finance, we must first become aware of the narratives that govern our choices. This journey begins by identifying those beliefs we uncovered earlier and understanding their origins. Were they acquired during childhood, influenced by societal standards, or perhaps molded by past experiences that left a lasting imprint? Recognizing the source of these beliefs is pivotal; it frames the context within which we need to operate to initiate meaningful change.

Once we’ve acknowledged these narratives, the next step is transformation. Reconditioning does not happen overnight; it’s a gradual process that requires consistent commitment and practice. Techniques such as visualization, affirmations, and guided meditations can serve as potent tools in this endeavor. For instance, visualizing yourself achieving specific financial goals can create emotional resonance, reinforcing a positive belief system. Affirmations, on the other hand, can be employed daily to replace negative self-talk with uplifting messages like “I am worthy of wealth” or “Money flows easily into my life.” These conscious efforts work to overwrite outdated scripts with empowering beliefs.

Moreover, mindfulness plays a crucial role in reconditioning. By practicing mindfulness and becoming present in our thoughts, we can identify when old beliefs creep back in, threatening our financial well-being. It becomes about being the observer of our thoughts rather than being reactive. Are we slipping into patterns of scarcity thinking when faced with an unexpected expense? Do we find ourselves doubting our abilities when something doesn’t go as planned? By recognizing these moments, we can once again affirm our commitment to our reconditioning journey, consciously steering our thoughts to empower rather than limit us.

One transformative method gaining traction is neuro-linguistic programming (NLP), which facilitates a deeper understanding of how language and communication shape our thoughts and behaviors. By altering the way we speak to ourselves and reinterpreting our experiences with money, we can literally change our brain’s wiring. Imagine replacing phrases like “I can’t afford that” with “How can I afford that?” This minor shift not only empowers but opens up the creative pathways to innovative solutions and opportunities.

As we embark on this reconditioning journey, it’s essential to surround ourselves with positive influences—those who share a growth mindset and foster financial conversations that inspire rather than discourage. Joining community groups, attending workshops, or seeking mentorship can significantly bolster our efforts. The more we immerse ourselves in an environment that encourages progressive thought patterns around money, the more likely we are to reinforce those new beliefs.

Reconditioning is a vital part of our personal evolution in managing finances. It is not merely about changing the way we think; it’s about reshaping our entire relationship with money. By consciously participating in this process, we can disarm the subconscious barriers that have held us back, allowing us to create an empowered financial narrative that resonates with our aspirations and dreams.

In the upcoming segment, we will explore innovative approaches to subconscious reconditioning that can enhance this transformative journey, equipping you with the strategies necessary to not just visualize but to actualize your financial goals.

Innovative Approaches to Subconscious Reconditioning

As we delve deeper into the fascinating world of subconscious reconditioning, it becomes clear that innovation is the heart of this transformative journey. Embracing cutting-edge strategies can significantly enhance our ability to reshape our financial beliefs and, ultimately, our financial reality. Here are some groundbreaking approaches that can elevate your reconditioning practice and help you cultivate a healthier relationship with money.

One of the most exciting methods emerging in recent years is the use of biofeedback technology. Biofeedback harnesses the mind-body connection, allowing individuals to gain insights into their physiological states through real-time data. Wearing a device that monitors heart rate variability or stress levels can provide an accurate picture of our emotional responses regarding financial decisions. By actively learning to regulate these responses—through techniques such as breathwork, meditation, or muscle relaxation—we can condition our subconscious minds to respond calmly and positively in financial scenarios that previously triggered anxiety and limiting beliefs.

Another innovative approach involves gamification—applying game-design elements to everyday life, including financial planning and money management. Imagine treating your savings goals like a video game where every milestone achieved unlocks rewards, such as a self-care treat or a weekend getaway. This method taps into our innate desire for challenge and accomplishment, transforming the daunting task of saving money into an engaging and fun experience. Platforms that incorporate gamification effectively have shown remarkable results, as they not only motivate individuals but also instill a proactive mindset toward financial growth.

Virtual reality (VR) and augmented reality (AR) technologies are also paving the way for revolutionary changes in our approach to subconscious reconditioning. Picture donning a VR headset to immerse yourself in a simulated environment where you can interact with money mindfully. In this virtual realm, you might practice negotiating a salary, budgeting your expenses, or even managing investments—each scenario designed to challenge limited beliefs about your financial capabilities. These immersive experiences can enhance our adaptability and resilience in real-world situations, reprogramming us to feel more confident and competent when dealing with financial matters.

Furthermore, incorporating sound therapy into your reconditioning practice can be a transformative experience. Utilizing specific frequencies—like binaural beats or solfeggio tones—can help entrain your brain to a state of calm and receptivity. Listening to soundscapes designed for financial abundance during meditation or even daily routines can assist in resonating with the vibrational frequency of wealth. As your subconscious begins to absorb these positive frequencies, it can more easily dissipate old narratives of scarcity, replacing them with a mantra of possibilities and growth.

Lastly, holistic wellness practices, including yoga and tai chi, are invaluable allies in the reconditioning journey. These ancient arts combine physical movement with a deep focus on embodiment and breath, in turn fostering a stronger connection between mind and body. Practicing mindful movement allows you to release accumulated tension and stress surrounding finances. As each posture unfolds, imaginations are ignited—creating new pathways toward wealth creation by embodying confidence and abundance. Integrating these practices helps solidify new beliefs about money as you learn to trust the flow of your financial journey.

As we explore the myriad of innovative approaches to subconscious reconditioning, it’s essential to remember that the journey is uniquely personal. Not every strategy will resonate with everyone, and that’s okay. The key is to experiment and find what combination of tools and practices aligns best with your lifestyle and aspirations. In the following section, we’ll uncover how this profound reconditioning can lead to tangible wealth, empowering you to turn your financial dreams into reality.

How Reconditioning Can Lead to Wealth

As we transition from innovative methods of subconscious reconditioning to its tangible benefits, one truth stands clear: the transformation of your mindset about money is a powerful catalyst for wealth creation. The intersection of psychological insight and financial success is where your reconditioning journey can culminate in remarkable outcomes. By actively reshaping the narratives you tell yourself about money, you can align your subconscious mind with a wealthy, abundant reality.

This alignment begins with understanding that many of our financial behaviors stem from deeply ingrained beliefs established in childhood. From perceptions of money as a source of stress to viewing wealth as a privilege for others, these beliefs can become self-fulfilling prophecies, shaping our decisions and ultimately our financial paths. The act of reconditioning involves rewiring your thought processes, allowing you to develop a mindset characterized by confidence, abundance, and opportunity.

A crucial aspect of this journey is recognizing the emotional ties we have to money. Transforming feelings of fear, shame, or guilt into feelings of security, excitement, and trust can open doors to new financial possibilities. Research suggests that individuals who engage in subconscious reconditioning often report an increase in financial risk-taking—whether that means investing in stocks, starting a business, or simply learning to save more intentionally. This sense of empowerment is foundational for creating and sustaining wealth.

| Reconditioning Aspect | Impact on Wealth Creation |

|---|---|

| Limiting Beliefs | Identify and release them, creating space for new possibilities. |

| Positive Affirmations | Reinforce a mindset of abundance, encouraging proactive financial behaviors. |

| Emotional Regulation | Improve responses to financial stressors, leading to clearer and more confident decisions. |

| Engagement in Wealth Practices | Establish routines centered around financial growth and stability. |

As you engage in reconditioning techniques, subtle shifts in your financial behaviors can gradually become significant leaps toward wealth. You may find yourself inspired to seek out new income streams, pursue career advancements, or take calculated risks that align with your long-term financial goals. Additionally, fostering a community of like-minded individuals who embrace similar financial aspirations can amplify this process. Sharing insights, experiences, and encouragement can reinforce your commitment to reshaping your financial destiny.

Moreover, studies indicate that the act of visualization—the process of envisioning your life once you achieve financial abundance—can further solidify this transformation. Imagine waking up each morning without financial concerns, freely investing in your passions, or donating to causes you believe in. This practice not only helps in reinforcing positive beliefs but also sets a vivid intention for your subconscious to work towards. Over time, as these new beliefs gain traction, your material reality will begin to reflect your inner financial landscape.

In essence, reconditioning your subconscious about wealth isn’t merely about changing how you think; it’s about cultivating an empowering belief system that serves to propel you towards wealth creation. As you begin this transformative journey, remember that the subconscious mind influences every aspect of your life—including your financial success. By embracing these techniques, you position yourself to not only dream of wealth but to manifest it in your everyday life. In the upcoming section, we’ll explore Simple Steps to Start Reconditioning Your Subconscious Today, guiding you to actionable strategies that can be implemented immediately on your path to financial prosperity.

Simple Steps to Start Reconditioning Your Subconscious Today

Reconditioning your subconscious to embrace wealth and abundance is an exhilarating journey that begins with simple yet profound steps. It’s essential to approach this process with patience and persistence, as small, consistent actions carry the potential to manifest significant change over time. Here’s how you can embark on this transformative path today:

- 1. Identify Limiting Beliefs: Start by taking stock of your current beliefs about money. Write down any negative thoughts or feelings that arise—whether it’s believing you’re not deserving of wealth or that money brings only trouble. Acknowledging these limiting beliefs is the first step toward dismantling them.

- 2. Create Positive Affirmations: Transform those limiting beliefs into empowering affirmations. Instead of saying, “I will never have enough money,” rephrase it to, “I am attracting wealth and opportunities every day.” Repeat these affirmations daily, ideally in front of a mirror, to reinforce your new narrative.

- 3. Practice Visualization Techniques: Set aside time each day to visualize your goals. Imagine your life filled with abundance—what does it feel like? Picture yourself making sound financial decisions, enjoying your earnings, and achieving financial milestones. This vivid imagery can create neural pathways in your brain that align with your aspirations.

- 4. Maintain a Gratitude Journal: Gratitude transforms your perspective on wealth. Start a journal where you document things you are grateful for, especially those related to your financial journey. Be it a stable job, a new skill you’ve acquired, or even a small windfall, acknowledging your current abundance helps attract more into your life.

- 5. Engage in Learning: Equip yourself with financial knowledge. Whether through books, podcasts, or workshops, the more you learn about managing money, investing, and wealth accumulation, the more confident you’ll feel in making financial decisions. Knowledge is empowering and reinforces the belief that you are capable of creating wealth.

- 6. Surround Yourself with Support: Connect with a community of like-minded individuals who share similar financial goals. This could be through online forums, local groups, or financial workshops. Engaging with others on a similar journey provides motivation, support, and invaluable insight that enhances your reconditioning process.

- 7. Consistency is Key: Integrating these practices into your daily routine is crucial. Dedicate time each day or week to focus on your subconscious reconditioning. As with any skill, the more you practice, the stronger your new beliefs will become, enabling them to permeate your actions and decisions.

By consistently applying these steps, you’ll begin to notice a shift in your mindset. As your relationship with money evolves, so too will your financial decisions. You’ll find that you become bolder in pursuing opportunities, better equipped to handle financial challenges, and more aligned with a life of abundance. Remember, the journey of reconditioning your subconscious is unique to you; approach it with curiosity and openness.

The most important takeaway as you begin this journey is that change starts with a single step. Every bit of progress you make, no matter how small, is a step toward unlocking your full potential and opening up vibrant new pathways to financial prosperity. Dare to dream, dare to redefine your beliefs, and let wealth in!

Understanding the subconscious mind is key to recognizing how it influences our financial decisions. The subconscious mind is the part of our psyche that stores our beliefs, memories, and experiences, operating without our conscious awareness. It acts as a powerful reservoir that influences our thoughts and actions, often dictating our behavior based on deeply ingrained beliefs formed during childhood or significant life experiences. For instance, if someone grew up in a family that stressed the importance of saving above all else, they may subconsciously fear spending, even when it’s necessary. This can manifest as self-sabotage in financial situations where investment or spending could lead to growth.

This subconscious influence isn’t limited to our attitudes towards spending; it extends to our ability to attract wealth and seize opportunities. When our subconscious is aligned with scarcity thinking, we might overlook promising financial prospects or miss critical investment opportunities, tied down by a fear of loss rather than a desire for gain. On the other hand, a subconscious rooted in abundance can make us more receptive to new ventures and financially savvy decisions.

The exciting news is that reconditioning the subconscious mind is possible through various methods. One engaging technique involves meditation, where individuals can access their subconscious and begin to confront and reshape their limiting beliefs. Mindfulness practices help create a state of awareness that can identify negative thought patterns without judgment. Other methods include hypnosis and neuro-linguistic programming (NLP), both of which seek to alter the inner dialogue and reconstruct automatic responses to financial situations.

But is subconscious reconditioning scientifically proven? Yes, there is a growing body of research supporting these methods. Studies in psychology have demonstrated how cognitive behavioral therapy (CBT) can effectively restructure ingrained beliefs, leading to improved financial behaviors. Additionally, neuroplasticity—the brain’s ability to reorganize itself—provides the scientific backbone for practices like visualization and affirmation, illustrating that repeated positive affirmations can physically alter the brain’s structure and functioning over time.

As with any transformative journey, one might wonder how long it takes to see tangible improvements in financial decisions through subconscious reconditioning. While results can vary significantly, many individuals report feeling a shift in their mindset within just a few weeks of consistent practice. However, profound changes that alter long-standing financial habits may take several months. Remember, the key is to approach this journey with patience and self-compassion, celebrating even small victories along the way.

In conclusion, the road to reconditioning the subconscious mind is an empowering one that invites you to challenge old beliefs and adopt a new mindset rich in abundance. As you engage in this introspective journey, you cultivate a more advantageous relationship with money that not only enhances your financial decision-making but also enriches your life. With every practice, every affirmation, and every step forward, you cement your path towards a more prosperous and fulfilling financial future.

Embracing the Journey: Transforming Your Financial Future

As you dive deeper into the process of reconditioning your subconscious, it’s important to recognize that this is not merely a checklist of tasks; it’s an unfolding journey of self-discovery and empowerment. Each step you take can be viewed not just as a means to an end but as an opportunity to reshape your thoughts, emotions, and ultimately your financial future. Every small victory serves to dismantle old paradigms, paving the way for a healthier relationship with money that resonates with your newfound beliefs.

As you progress, be mindful of how your emotional responses to financial situations begin to shift. Do you feel less anxiety when facing your monthly budget? Are you more inclined to view unexpected expenses as opportunities for growth rather than burdens? This emotional transformation is a sign that your subconscious mind is adapting, liberating you from the chains of past thought patterns.

But let’s delve deeper—how can this reconditioning manifest in your daily life? Consider how your transformed mindset can lead to proactive financial behaviors. For example, with a belief rooted in abundance, you might find yourself more willing to invest in a new course to upskill, leading to better job prospects and salary growth. You may even feel inspired to explore entrepreneurial ventures, tapping into talents you previously undervalued. This newfound confidence and openness to opportunity can position you to take advantage of avenues that once seemed daunting or unattainable.

Furthermore, as you continue reinforcing your positive affirmations and visualizations, anticipate that your attraction to wealth will not only reflect in your financial status but also seep into the quality of your relationships and overall happiness. Financial health is often intertwined with emotional well-being, and a richer internal landscape can create ripples beyond mere dollar signs. Increased self-worth can foster a deeper sense of purpose, encouraging connections with others who inspire and uplift you on this quest for abundance.

Your journey may not always feel linear, and that’s okay. Embrace the twists and turns as part of the learning experience. Perhaps you might experience setbacks that challenge your newly established beliefs. Don’t view these moments as failures; instead, consider them critical lessons that arm you with insights to recognize and overcome obstacles in the future. Each challenge you face will fortify your mental resilience and sculpt a mindset that thrives even amidst adversity.

In the grand scheme of things, you are not just cultivating wealth in a material sense but rather crafting a lifestyle that celebrates success, joy, and fulfillment. As you take these essential steps towards reconditioning your subconscious, remain steadfast in your journey. Develop a curiosity for what lies ahead, allowing yourself to dream bigger than you ever thought possible. The act of believing in your journey towards prosperity can manifest real change, unlocking opportunities that once felt out of reach.

Ultimately, remember: transformation is a continuous process, and with every decision you make, you’re shaping not only your relationship with money but also the entire narrative of your life. Embrace the journey, trust the process, and know that as you acknowledge the power you hold over your financial beliefs, you are crafting a legacy that can inspire generations to come. Now is the time to take that first step—because every bit of progress you achieve today is an investment in a future that awaits with endless potential.